THE TITLE AND ESCROW PROCESS EXPLAINED

UNDERSTANDING TITLE AND ESCROW ~

Buying or selling a home is exciting — but it can also feel overwhelming if you’re not familiar with the Title and Escrow process.

This behind-the-scenes work is what keeps your real estate transaction safe, secure, and legally protected.

Whether you’re a first-time buyer or seasoned seller, here’s a simple guide to help you understand what happens from start to finish.

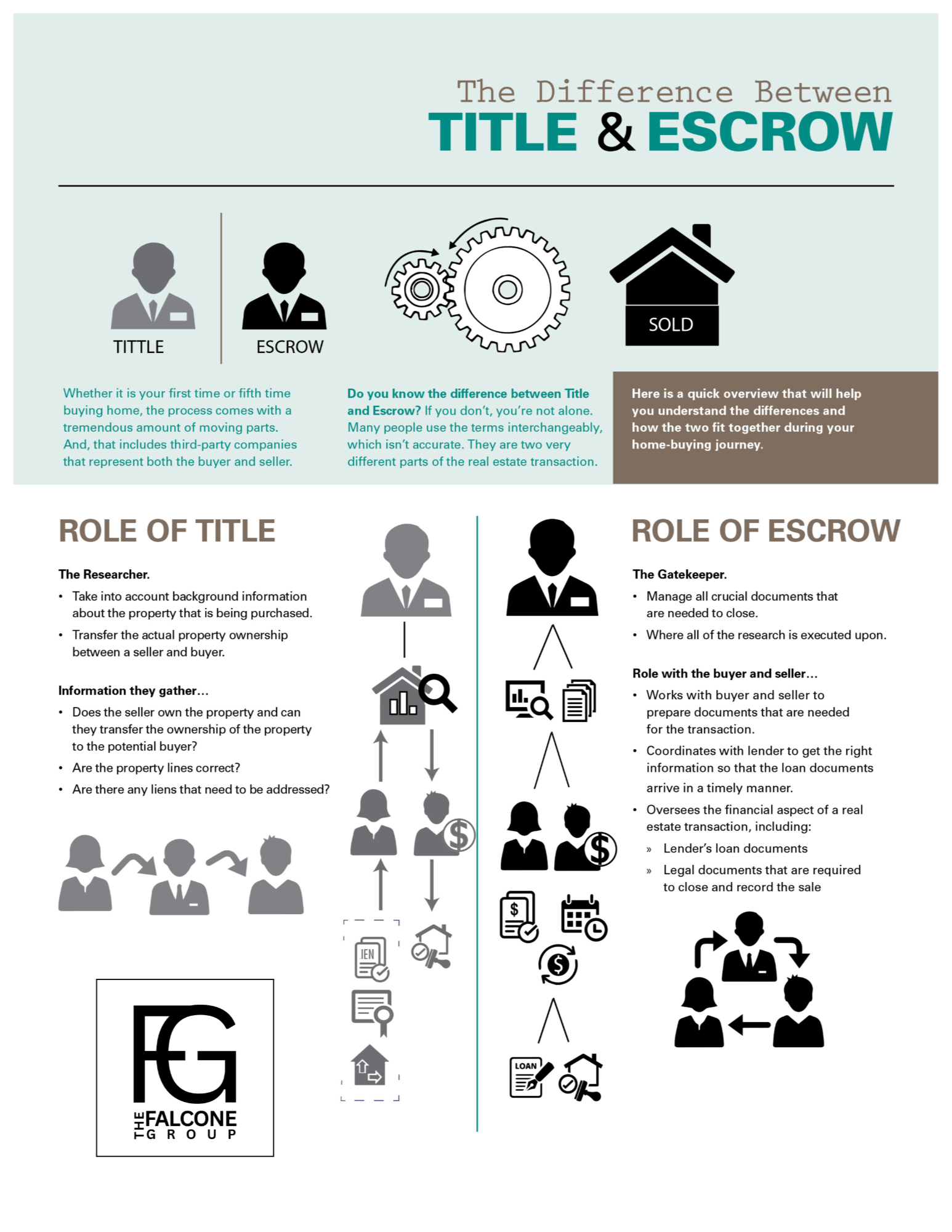

What Is “Title” in Real Estate?

Title is the legal right to own and use a property.

A Title Company ensures that when the property changes hands, the buyer receives clear ownership — free from liens or legal issues.

Key Title Steps:

- Preliminary Title Report (Prelim):

- Shows the current ownership and any existing liens or loans

- Alerts buyers and sellers to potential title issues early

- Title Search:

- Confirms there are no unpaid taxes, claims, or unknown heirs

- Verifies legal boundaries and property details

- Title Insurance:

- Protects the buyer (and lender) from future claims against the property

Tip: Always review your prelim carefully with your agent or escrow officer so there are no surprises later.

What Is Escrow?

Escrow is a neutral third party (often the title company) that holds and manages funds and documents during the transaction. Their job is to make sure everyone does what they agreed to before closing.

Escrow Essentials:

- Holds earnest money deposit securely

- Coordinates signing of required documents

- Tracks loan and inspection timelines

- Collects final funds from buyer and pays out to the seller

- Records the deed with the county to make ownership official

Tip: Escrow protects both buyer and seller by making sure funds and property transfer only when all conditions are met.

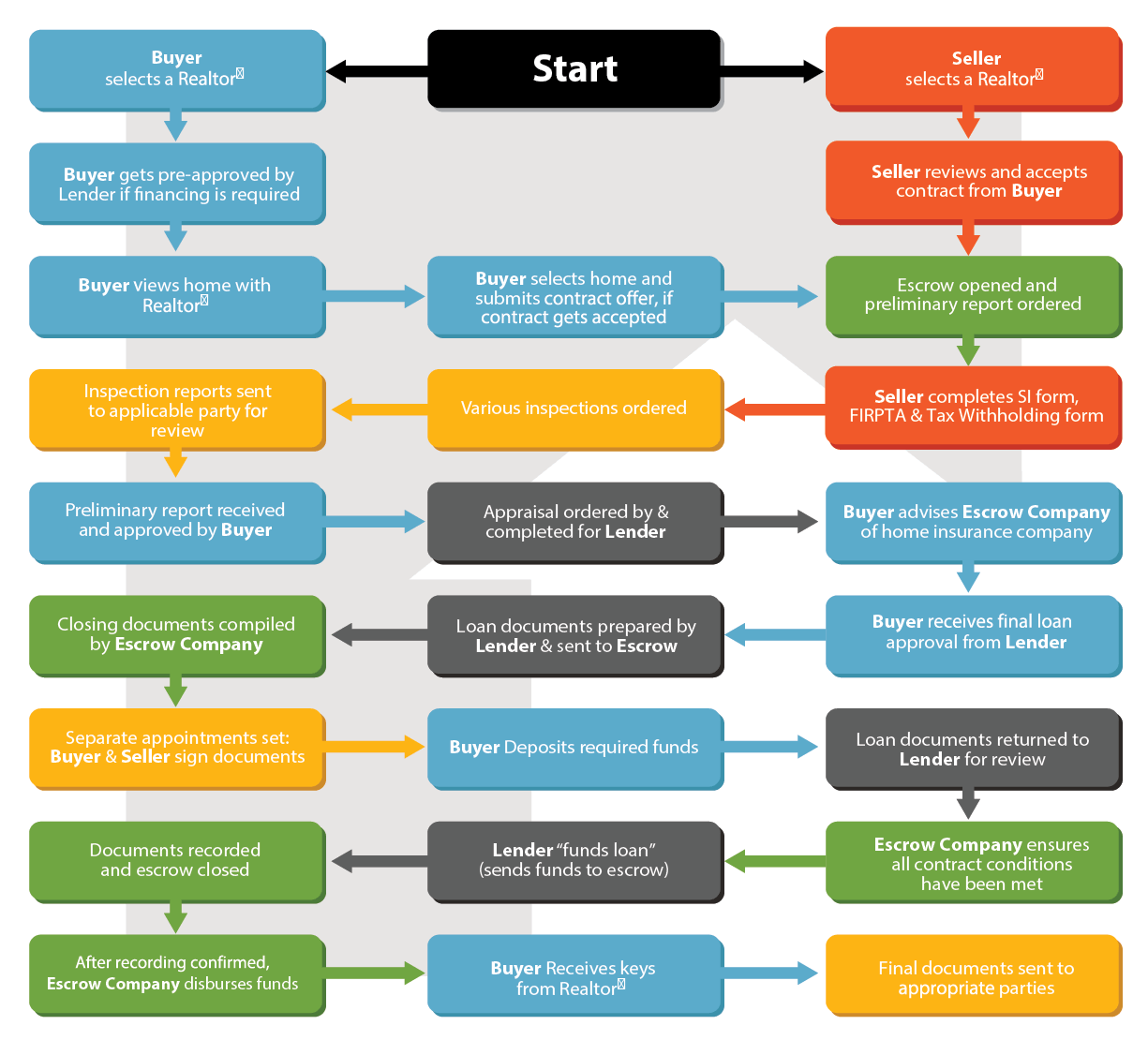

Step-by-Step: What to Expect

Step-by-Step: What to Expect

For Buyers:

- Receive & review prelim title report

- Send earnest money to escrow

- Complete inspections & loan requirements

- Sign closing documents

- Get the keys once the sale records!

For Sellers:

- Clear up any liens or issues found in the title search

- Work with escrow to provide required documents

- Sign your seller paperwork

- Receive your proceeds after recording

Top Tips for a Smooth Title & Escrow Experience

✅ Stay in communication with your agent, lender, and escrow officer

✅ Review documents early — don’t wait until closing day

✅ Wire funds securely — always confirm instructions by phone

✅ Respond quickly to any escrow or title requests

✅ Ask questions — no question is too small when protecting your investment

Understanding title and escrow doesn’t have to be complicated.

With the right team and a clear process, your closing can be smooth and stress-free.

Download Your Free Title & Escrow Guide

Includes:

• Full step-by-step checklists • Important contacts • Pro tips for a faster close • Frequently asked questions

GET MORE INFORMATION