HOW INTEREST RATES IMPACT YOUR BUYING AND SELLING POWER

INTEREST RATES 101 ~

When it comes to real estate, few things influence the market as much as interest rates. Whether you're buying your first home, upgrading, or considering selling, understanding how rates affect your buying and selling can help you make smarter decisions — and potentially save (or earn) thousands.

Let’s break it down in simple terms.

What Are Interest Rates?

An interest rate is the cost of borrowing money. When you take out a mortgage, your lender charges interest on the loan amount, and that rate determines how much you’ll pay over time.

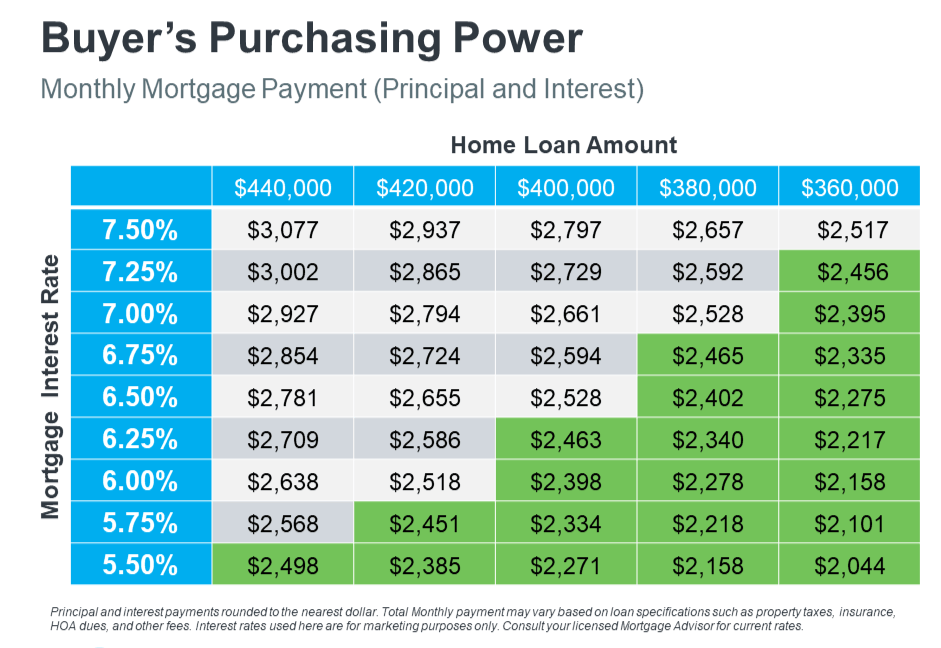

Even a small change in rates can have a big impact. For example:

- A 1% increase in interest rates can reduce your buying power by about 10%.

- A 1% decrease can make the same home suddenly fit comfortably within your budget.

How Interest Rates Affect Buyers

When rates go down, your monthly payment becomes more affordable — meaning you can qualify for a higher-priced home or simply enjoy a lower payment for the same home.

When rates go up, the opposite happens: your purchasing power decreases because more of your monthly payment goes toward interest rather than the loan balance.

Example:

- A $500,000 loan at 6.5% interest = about $3,160/month (principal + interest).

- The same loan at 5.5% interest = about $2,840/month.

That’s over $300 less every month — or nearly $100,000 in savings over the life of the loan.

Buyer Tip:

If you’re planning to buy, watch the market and talk with your lender early. Getting pre-approved can lock in a favorable rate — even before you find your home.

How Interest Rates Affect Sellers

You might think interest rates only matter to buyers — but sellers are equally impacted. When rates rise:

-

-

-

-

-

-

-

- Fewer buyers qualify for higher-priced homes.

-

-

-

-

-

-

- Demand may cool, leading to longer days on market and price adjustments.

When rates fall:

- More buyers enter the market.

- Homes tend to sell faster and often closer to asking price (or even above).

Seller Tip: If you’re selling in a higher-rate environment, focus on presentation and pricing. Homes that show well and are priced strategically will still move — even when borrowing costs are higher.

Why Rates Change

Interest rates are influenced by several factors, including:

- The Federal Reserve’s policy decisions

- Inflation trends

- Economic growth and employment data

- Global events that affect investor confidence

Rates naturally fluctuate — so timing your move with a local real estate expert can make a big difference.

Finding Opportunity in Any Market

Here’s the truth: there’s always opportunity in real estate.

When rates are low, buyers enjoy greater affordability.

When rates are higher, sellers face less competition and buyers have more negotiating power.

The key is understanding how to position yourself strategically — whether that means refinancing, buying sooner, or adjusting your price point.

Final Thoughts

Interest rates might seem like just a number, but they directly shape how much home you can afford and how quickly your home sells. Understanding them gives you the edge you need to make smart, confident real estate decisions.

If you’d like to know how current rates are affecting your specific buying or selling plans, let’s connect. We’ll walk you through your options, share local market insights, and help you make the most of today’s conditions.

Contact The Falcone Group today to talk about your real estate goals — and how to make interest rates work for you.

GET MORE INFORMATION